Gold Price Forecast: XAU/USD bears are gaining ground, $1,885 critical support – Confluence Detector

- Gold has been unwinding the war-related gains, dropping under $1,900.

- Critical support awaits at $1,885, followed only by $1,868.

- Resistance is at $1,899, then $1,902, if the precious metal recovers.

Will hostilities end in Ukraine? Russia's offer to talk in Minsk has been underpinning a market recovery. The move to stocks from bonds means lower yields, which in turn, has pushed gold lower.

How is gold positioned on the technical chart?

Gold Price: Key levels to watch

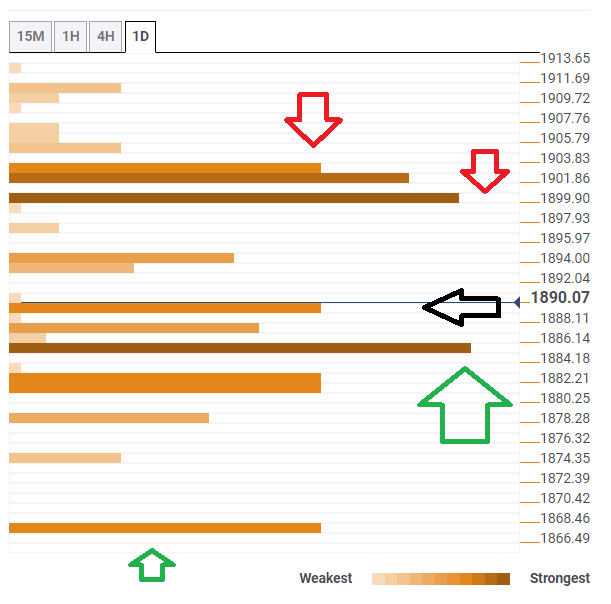

The Technical Confluences Detector is showing that gold is struggling around $1,889, which is the convergence of the Fibonacci 23.6% one-week and the SMA 5-15m.

Looking down, $1,885 is a juncture of lines including the Pivot Point one-month Resistance 2 and the 10-day Simple Moving Average. It is critical support.

Looking down, the next level to watch is $1,868, which is where the Fibonacci 61.8% one-week hits the price.

Resistance is at $1,899, which is the confluence of the Bollinger Band 15min-Middle and the Fibonacci 161.8% one-month.

Close by, $1,902 is another tough cap, which is where the Fibonacci 23.6% one-day and the 5-day SMA converge.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.