Back

2 Nov 2021

Crude Oil Futures: Correction lower on the cards

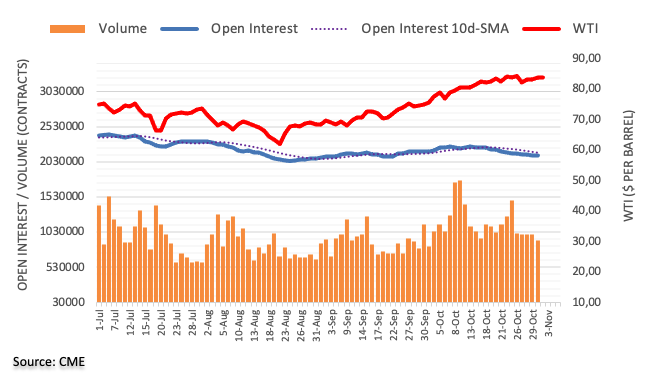

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by just 906 contracts on Monday, reaching the eighth consecutive daily pullback. In the same direction, volume resumed the downside and dropped by nearly 77K contracts.

WTI still targets $85.00 and above

Prices of the WTI extended the positive performance for yet another session on Monday. The move, however, was on the back of shrinking open interest and volume, showing the presence of short covering behind the move and allowing for some corrective downside in the short-term horizon. Despite the likelihood of a corrective decline, crude oil prices continue to target the 2021 highs well north of the $85.00 mark per barrel for the time being.