A covid-tantrum on the cards for today's RBA

It is judgment day from the Reserve Bank of Australia which meets to discuss the greater risks around the 2022 outlook pertaining to the recent lockdown extension since the members last met.

Markets are of the mind that the central scenario of a strong rebound next year is intact.

However, the outcome of today's meeting now looks like a coin toss as the Delta variant spreads, piling pressure on the RBA to delay a planned tapering of its bond-buying program, or even to ease.

Lockdowns might not be going away and the fight for normality has gone from bad to worse in such cities as Melbourne whereby health authorities admitting today's 176 cases is a demoralising blow for a city staring down months in lockdown.

Meanwhile, Premiers have slammed a Federal Minister's suggestion that the National Plan for reopening could change.

Currently, the Doherty modelling recommends a vaccination rate of 70 to 80 per cent to end harsh COVID restrictions.

However, Employment Minister Stuart Robert has caused some confusion suggesting the thresholds for reopening could be changed at any time if case numbers keeping rising.

Victorians who have had one dose of AztraZenca can now receive their second jab after 6 weeks instead of waiting three months, in a bid to ramp up vaccination rates.

There was also good news recently of Prime Minister Scott Morrison announcing the deal would add 4 million Pfizer doses to Australia's supplies, doubling the nation's Pfizer supply this month.

The first flight from London was carrying 164,970 doses landed on Sunday evening while the second, carrying 292,500 doses, arrived a few hours later.

Deputy Chief Medical Officer Sonya Bennett said the extra vaccines had bolstered the vaccine rollout which should be reassuring for the RBA today.

Having said that, it is still a very fluid situation for which the RBA will need to consider today.

Ongoing lockdowns are not what the RBA had pencilled down at their last meeting.

They are likely to have a very acute impact on the economy, much more than what the RBA had initially thought.

The RBA had forecast a jobless rate of 5% by year-end but that number could come under pressure into the final stages of the year, forcing the RBA to recalibrate its game plan for 2022.

Bank analysts comments here: RBA Preview: Forecasts from 10 major banks, anticipating a dovish stance

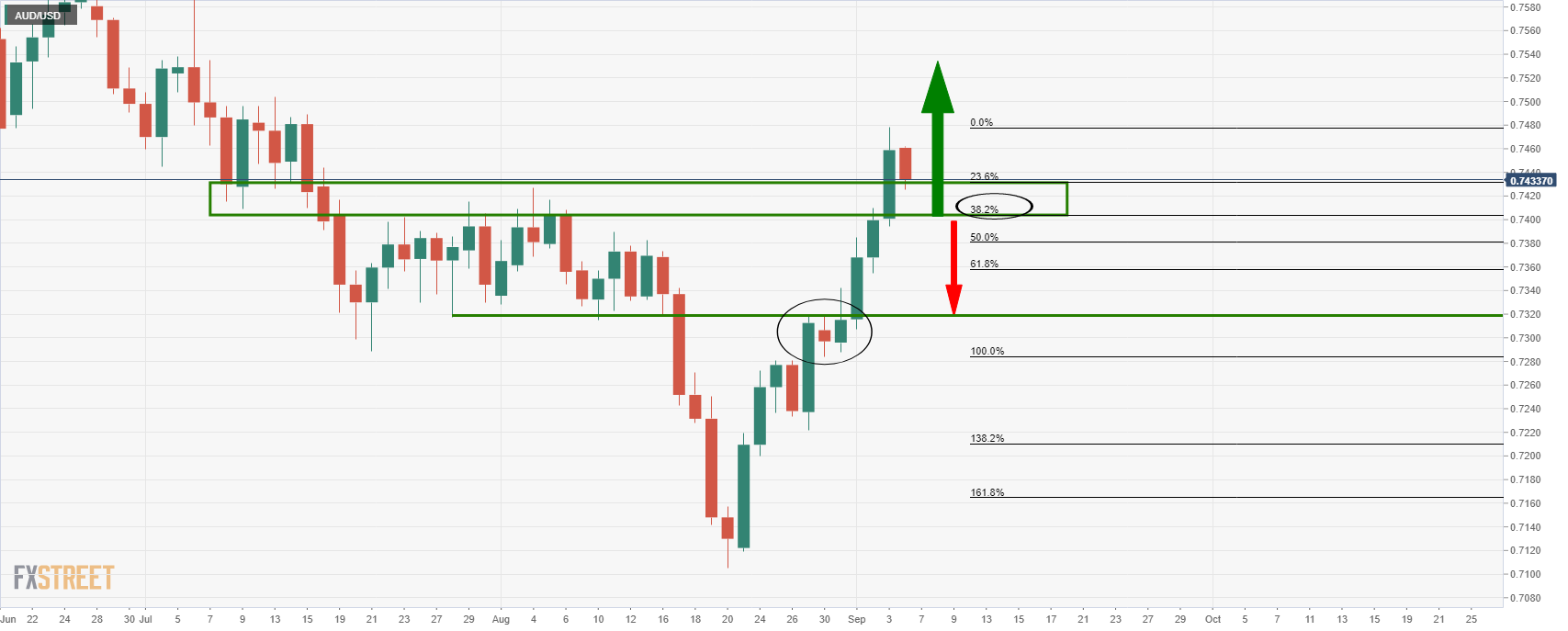

AUD/USD technical analysis

The price is on course for a restest of the 38.2% Fibo or a possible run down to the 50% ratio if bulls do not commit at this juncture.

Failing that, there is support all the way beyond the 61.8% ratio near the Aug 30 structure between 0.73 the figure and 0.7320.

On the upside, bulls may commit and see 0.7480 and then 0.75 taken on.

0.7650 marks the weekly spring lows done in April 2021.