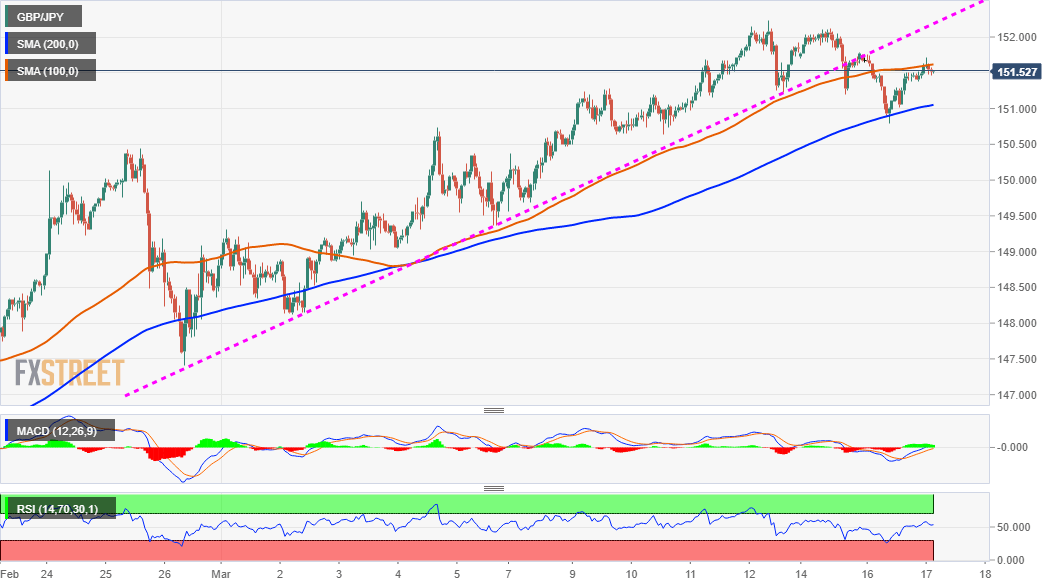

GBP/JPY Price Analysis: Clings to modest gains around mid-151.00s, 100-hour SMA

- An offered tone around the JPY assisted GBP/JPY to gain some traction on Wednesday.

- Bulls now seemed struggling to lift the cross above the 100-hour SMA support breakpoint.

- Investors might refrain from placing aggressive bets ahead of the central bank meetings.

The GBP/JPY cross edged higher during the Asian session and built on the previous day's goodish rebound from four-day lows, around the 150.80-75 region. The cross was last seen hovering around mid-151.00s and was supported by an offered tone surrounding the Japanese yen.

The uptick, however, lacked any follow-through and struggled to lift the GBP/JPY cross back above 100-hour SMA. This is closely followed by a short-term ascending trend-line support breakpoint, around the 152.00 mark, which should act as a pivotal point for short-term traders.

Meanwhile, neutral technical indicators on hourly charts haven't been supportive of any firm intraday direction. Moreover, RSI (14) on the daily chart is still holding in the overbought territory and warrants some caution before positioning for any meaningful appreciating move.

Traders might refrain from placing aggressive bets, rather prefer to wait on the sidelines ahead of this week's key central bank events. The Bank of England will announce its latest monetary policy decision on Thursday, while the Bank of Japan is scheduled to meet on Friday.

In the meantime, momentum beyond the 100-hour SMA is likely to remain capped near the 152.00 support-turned-resistance. That said, some follow-through buying will negate any near-term bearish bias and set the stage for an extension of the recent strong upward trajectory.

On the flip side, immediate support is pegged near the 151.25 horizontal level. This is closely followed by 200-hour SMA support, around the 151.00 mark, which if broken decisively might be seen as a fresh trigger for bearish traders and pave the way for further weakness.

The GBP/JPY cross might then turn vulnerable to break below the overnight swing lows, around the 150.80-75 region and accelerate the slide to challenge the 150.00 psychological mark. The momentum could eventually drag the cross to the 149.70-65 next relevant support.

GBP/JPY 1-hourly chart

Technical levels to watch