EUR/USD Price Analysis: Eases inside monthly rising wedge below 1.2200

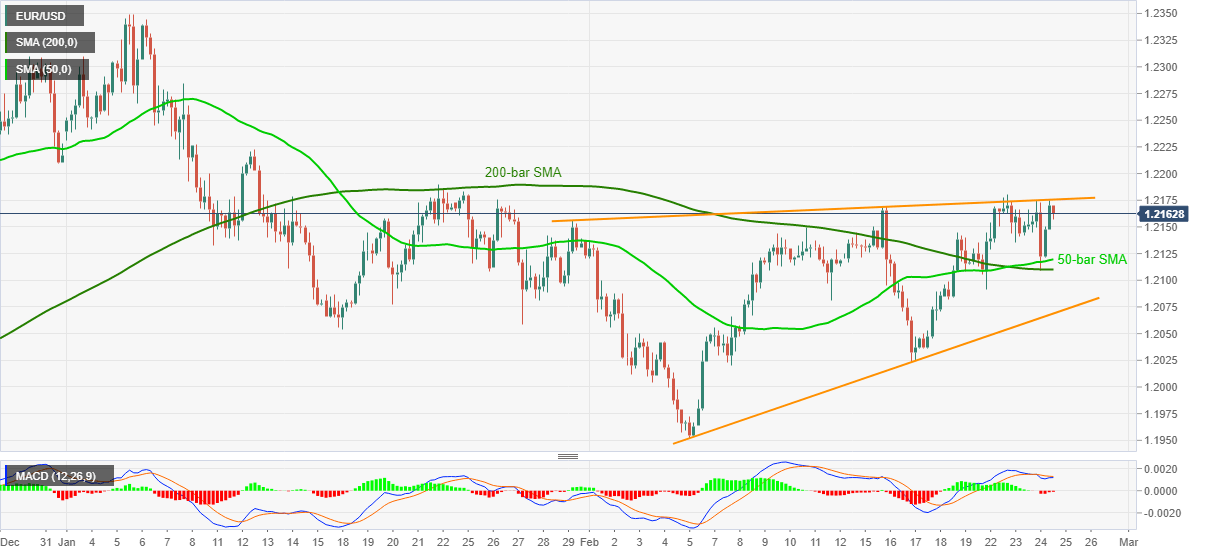

- EUR/USD remains pressured around intraday low inside a bearish chart pattern.

- 50, 200-bar SMA restrict short-term downside, bulls need validation from late January tops.

EUR/USD drops to 1.2159, intraday low 1.2156, amid Thursday’s Asian session. In doing so, the currency major takes a U-turn from the upper line of a one-month-old rising wedge bearish chart formation amid bearish MACD signals.

The quote currently declines towards the 50-bar SMA level of 1.2119. Though, its further downside will be tested by 200-bar SMA, at 1.2110.

In a case where EUR/USD sellers refrain from bouncing off the key SMA, the support line of the stated chart pattern near 1.2070 becomes the key as a downside break will confirm a theoretical bearish move targeting 1.1850.

Though, the 1.2000 psychological magnet and the yearly bottom surrounding 1.1950 adds to the downside filters.

Meanwhile, a clear break above the immediate resistance line around 1.2175 will not give a green pass to the EUR/USD bulls as multiple stops to the north marked in January close to 1.2200 will challenge the upside.

EUR/USD four-hour chart

Trend: Pullback expected