Back

26 Mar 2020

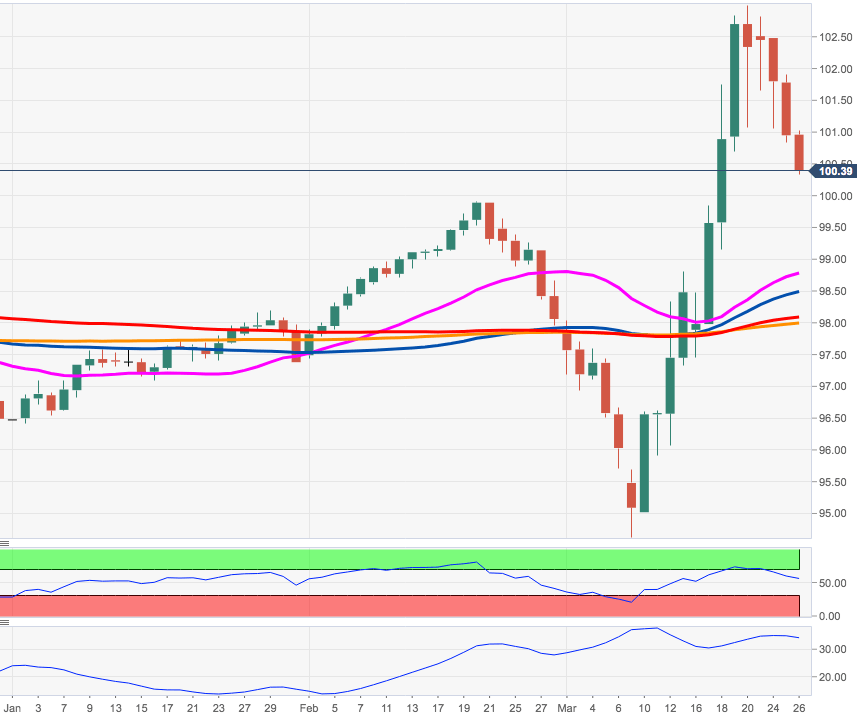

US Dollar Index Price Analysis: Door open for a visit to 100.00

- DXY continues to correct lower after failing just below 103.00.

- The continuation of the leg lower could extend to the 100.00 mark.

DXY remains on the defensive and keeps fading the move to the boundaries of the 103.00 mark, or 3-year highs, recorded earlier in the week.

The index is already flirting with the Fibo retracement (of the 2017-2018 drop) in the mid-100.00s and further decline is expected to test the psychological triple-mark support.

Despite the corrective downside and looking at the broader picture, the positive outlook in the buck remains unchanged as long as the 200-day SMA, today’s at just below 98.00, underpins.

DXY daily chart