Back

21 Jun 2019

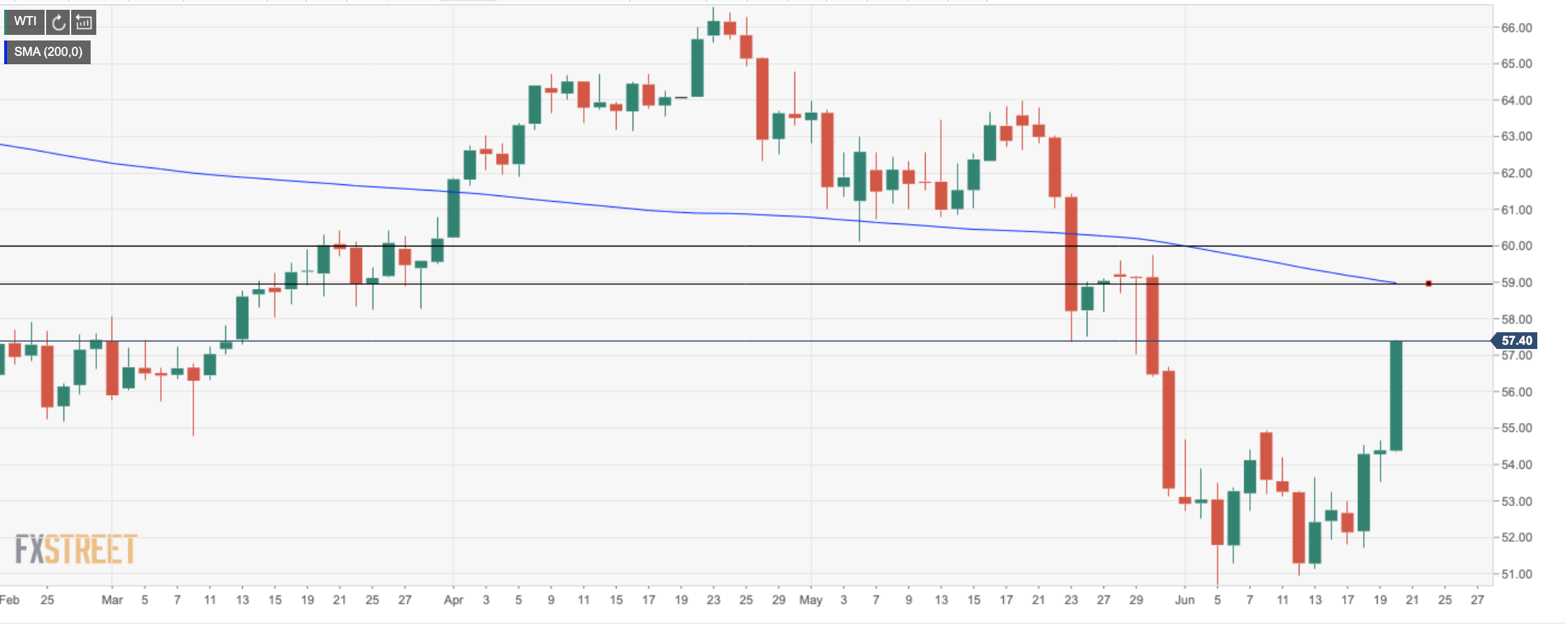

WTI technical analysis: Bulls looking to the 200-D EMA

- Bulls aim for the $60 handle while in control above the 50-D Experiential Moving Average.

- Bears can aim for the 200 weekly EMA and the 61.8% Fibo.

The price of oil climbed through the 20-D Experiential Moving Average, (EMA), and the 50-D EMA, now en route for the 200-D EMA. Bulls now aim for a break there with eyes set on the 30th May highs of $59.67 which comes just below $60 psychological level. Meanwhile, if the bulls hold out, bears will look back towards the 200 weekly EMA and the 61.8% Fibo. Thereafter, the 14th Jan 50.41 low and then the 26th November lows at 49.44 will be in sight.