Back

20 Nov 2018

EUR/USD Technical Analysis: Current bull move looking weak in the near-term

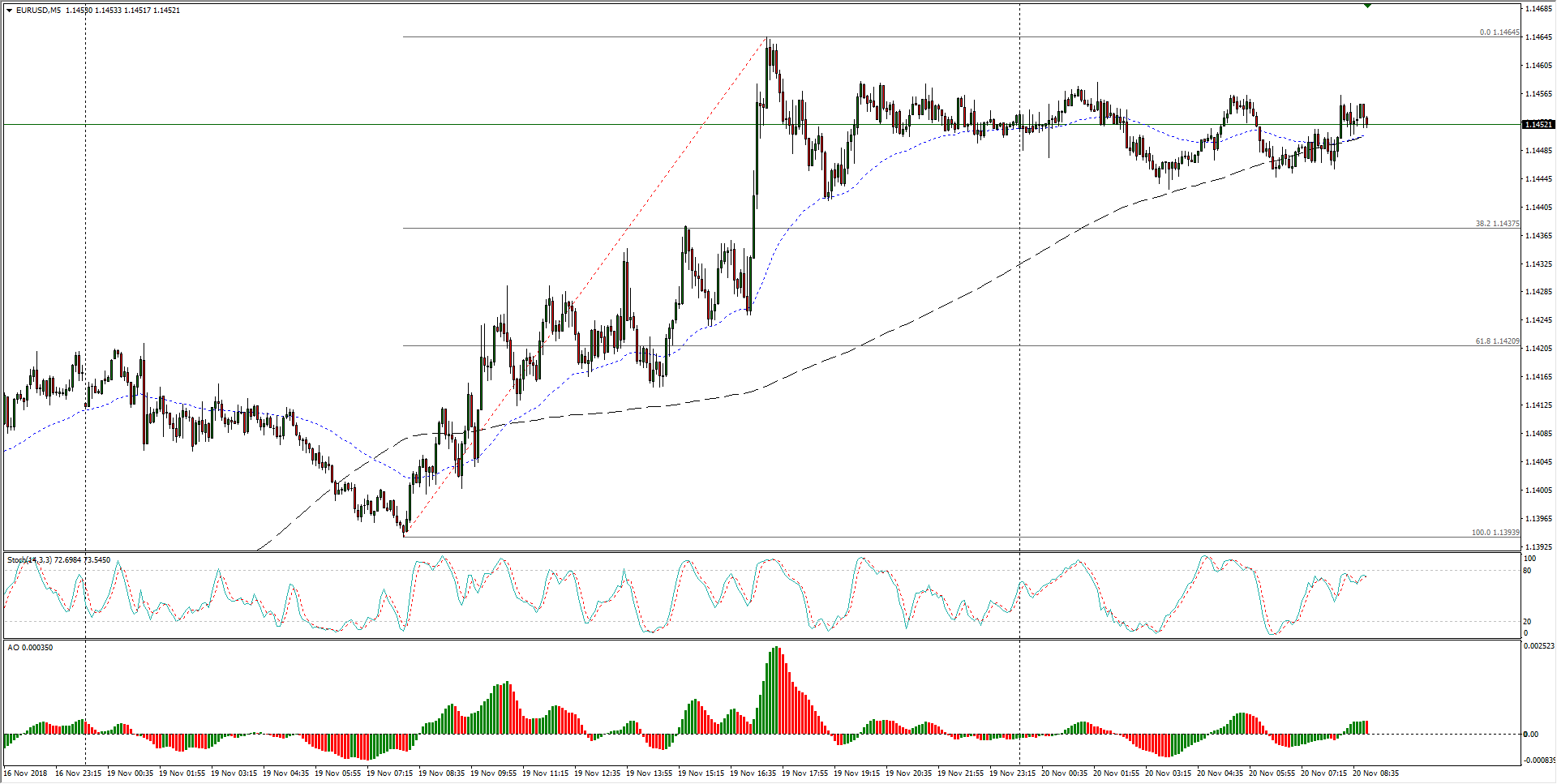

- The last twenty-four hours in the EUR/USD sees intraday action near the 1.1450 level heading into Tuesday's major market sessions, after catching a confusing lift on Monday from a floor near 1.1390.

- Intraday support is sitting at the 38.2% Fibo retracement level near 1.1435, and it could be a pivotal intraday zone.

- EUR/USD Analysis: Rallies despite Italian budgetary concerns

EUR/USD Chart, 5-Minute

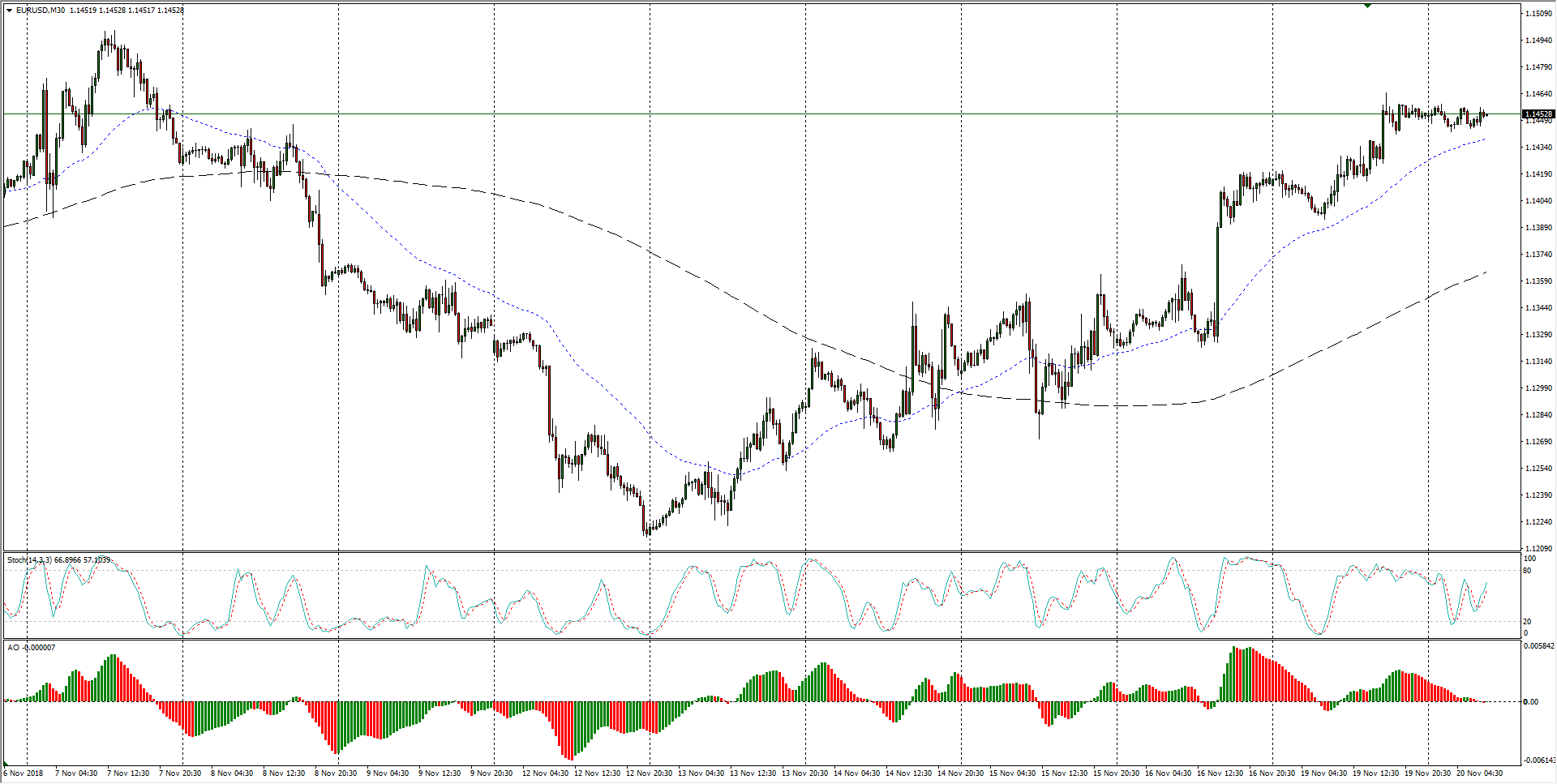

- Over the past two weeks, the Fiber bounced from the 1.1200 zone to stage a near-term bullish correction, and with the 100-hour moving average resting at 1.1360, a decline to this region is likely to see some bidding about the region as buyers try to force a fresh higher low.

EUR/USD Chart, 30-Minute

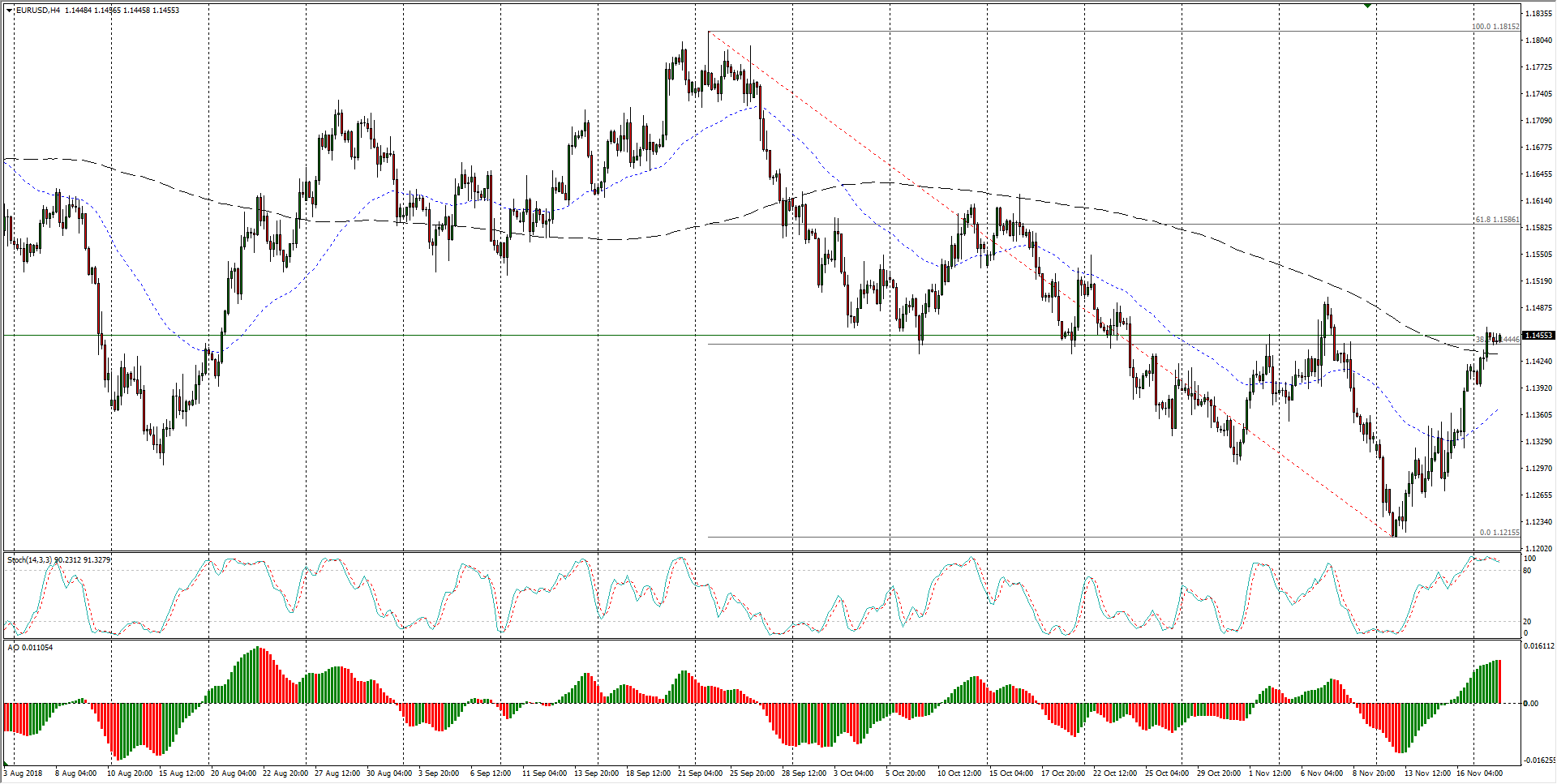

- Going back over the past four months, the EUR/USD remains in a dedicated downtrend, though medium-term boundaries are currently being tested, with the latest bull run facing a confluence zone at the 38.2% Fibo retracement level alongside the 200-period moving average, a dynamic resistance indicator that has kept the Fiber in chains since falling from a medium-term peak of 1.1815.

EUR/USD Chart, 4-Hour

EUR/USD

Overview:

Last Price: 1.1453

Daily change: 1.0 pips

Daily change: 0.00873%

Daily Open: 1.1452

Trends:

Daily SMA20: 1.1374

Daily SMA50: 1.1509

Daily SMA100: 1.1561

Daily SMA200: 1.1811

Levels:

Daily High: 1.1466

Daily Low: 1.1394

Weekly High: 1.142

Weekly Low: 1.1216

Monthly High: 1.1625

Monthly Low: 1.1302

Daily Fibonacci 38.2%: 1.1438

Daily Fibonacci 61.8%: 1.1421

Daily Pivot Point S1: 1.1409

Daily Pivot Point S2: 1.1365

Daily Pivot Point S3: 1.1336

Daily Pivot Point R1: 1.1481

Daily Pivot Point R2: 1.1509

Daily Pivot Point R3: 1.1553