Back

15 Nov 2018

USD/CAD Technical Analysis: 1.3250 resistance is a brick wall - Good luck for bulls !

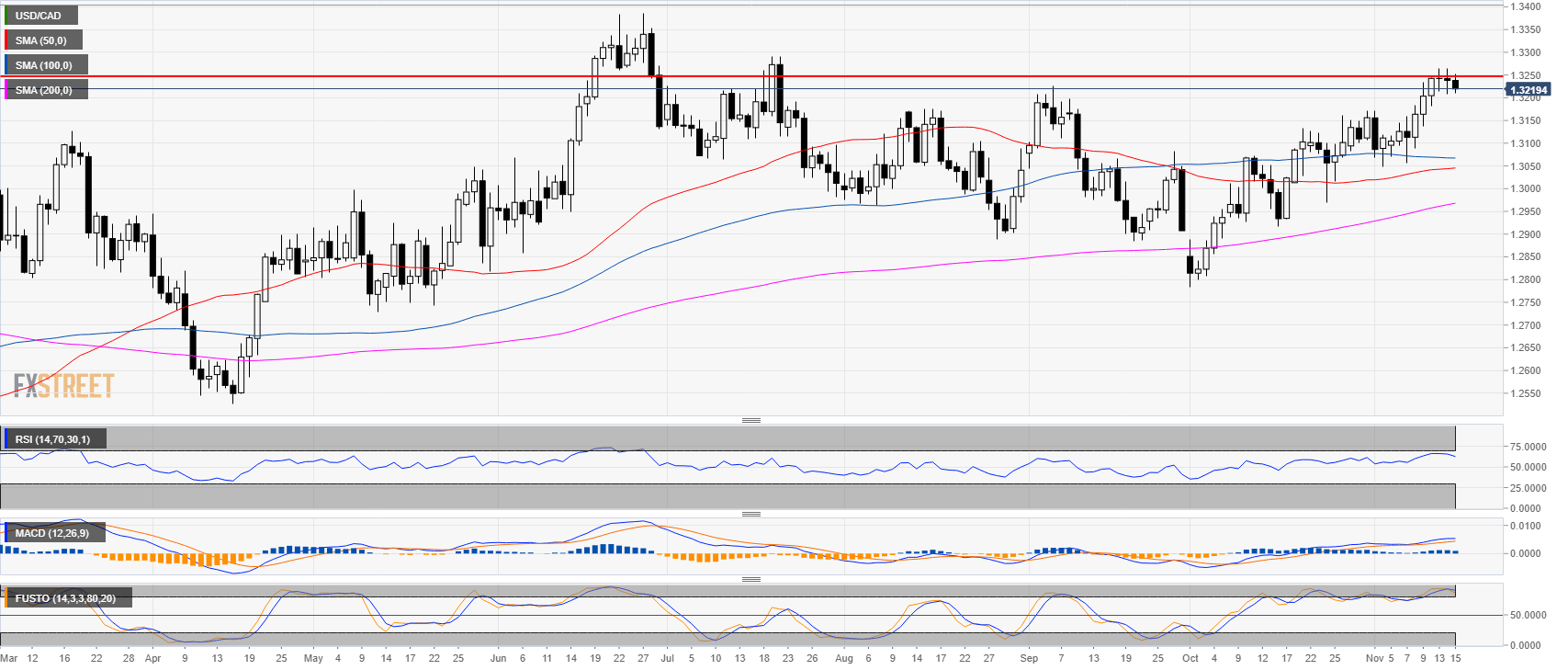

USD/CAD daily chart

- USD/CAD is finding resistance at the 1.3250 resistance for the fourth day in a row.

- The Stochastic indicator has been trading in and out of the overbought zone for about a month.

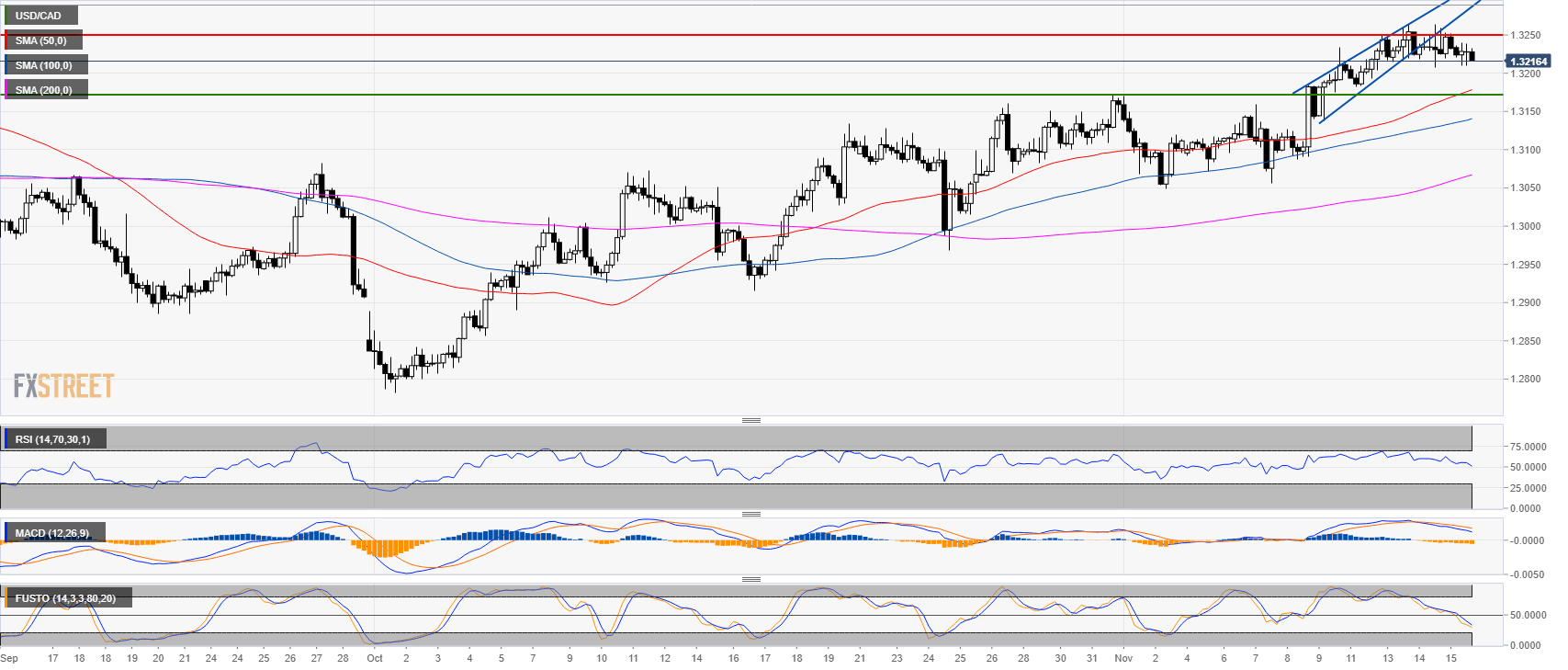

USD/CAD 4-hour chart

- The rising wedge is preventing the bulls to advance above 1.3250.

- Technical indicators are bearish, only the RSI is still above its 50 line.

- The 1.3170 level is the target for bears.

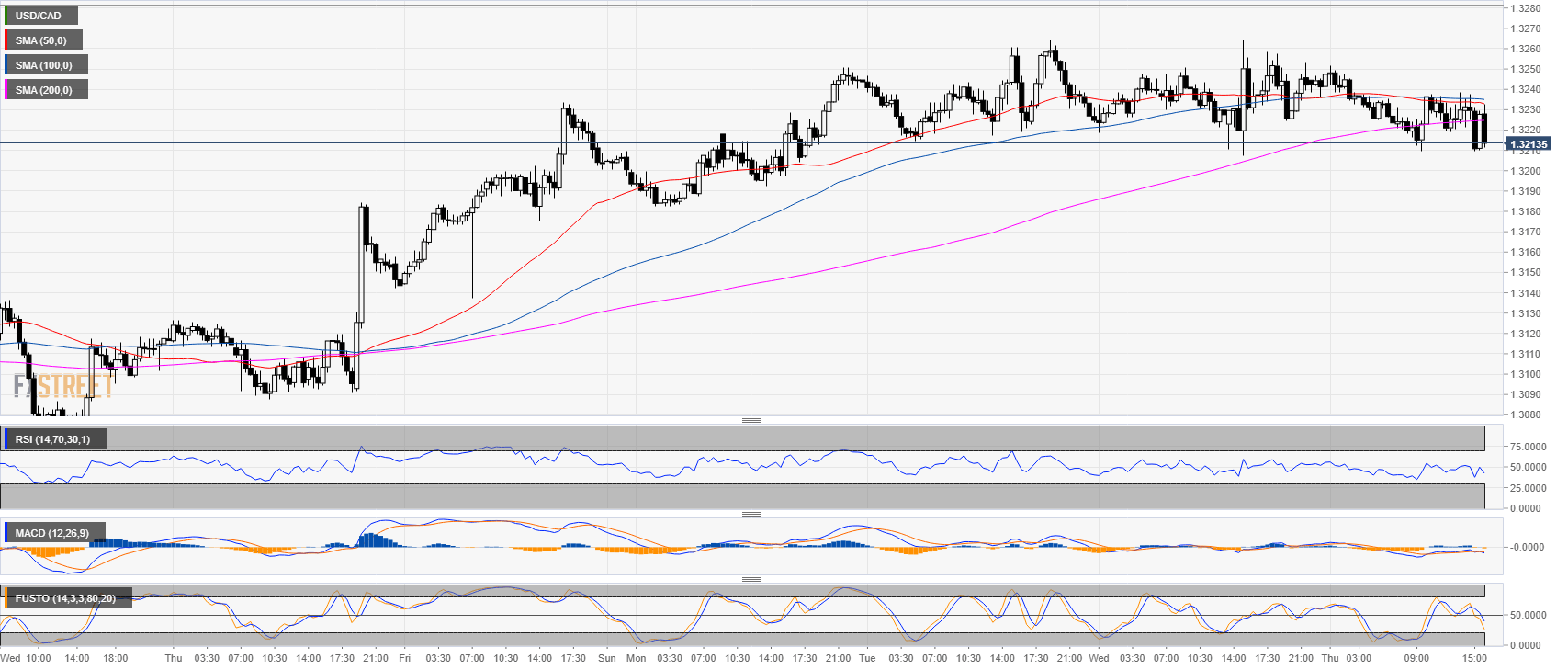

USD/CAD 30-minute chart

- USD/CAD is trading below its main SMAs.

- Technical indicators are all in bearish territories.

- More down likely.

Additional key levels at a glance:

USD/CAD

Overview:

Last Price: 1.322

Daily change: -18 pips

Daily change: -0.136%

Daily Open: 1.3238

Trends:

Daily SMA20: 1.3132

Daily SMA50: 1.3045

Daily SMA100: 1.307

Daily SMA200: 1.296

Levels:

Daily High: 1.3264

Daily Low: 1.3208

Weekly High: 1.3233

Weekly Low: 1.3056

Monthly High: 1.3172

Monthly Low: 1.2783

Daily Fibonacci 38.2%: 1.3229

Daily Fibonacci 61.8%: 1.3243

Daily Pivot Point S1: 1.3209

Daily Pivot Point S2: 1.318

Daily Pivot Point S3: 1.3152

Daily Pivot Point R1: 1.3266

Daily Pivot Point R2: 1.3294

Daily Pivot Point R3: 1.3323