GBP/JPY Technical Analysis: Turns higher for second straight session after mixed UK data

• The cross regained positive traction from the 143.00 neighborhood and refreshed session tops following the release of mixed UK economic data.

• The uptick, however, lacked any strong follow-through/conviction and remained capped amid the prevalent cautious mood across global financial markets.

• Neutral technical indicators on hourly/daily charts have failed to support any firm directional bias, albeit Brexit optimism remained supportive.

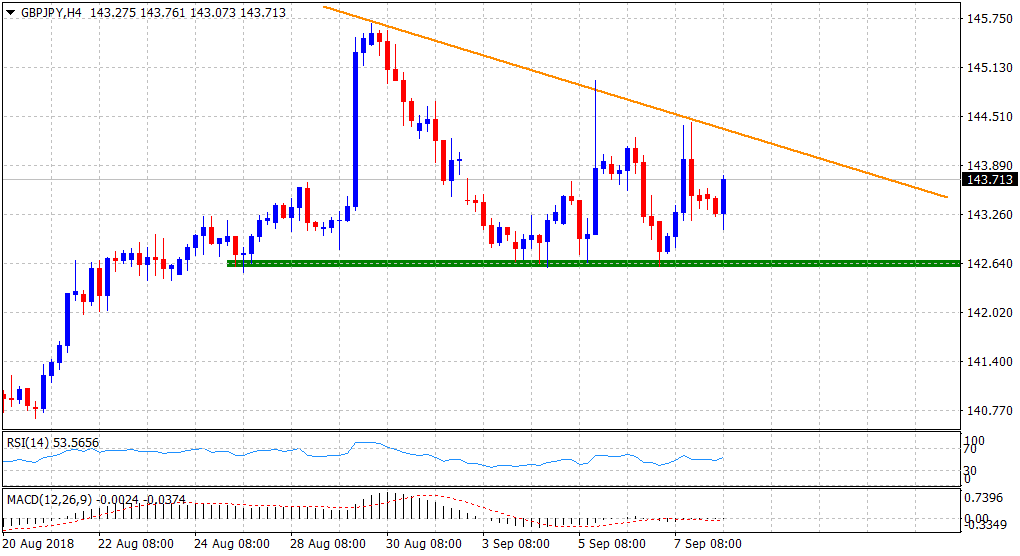

• Any meaningful up-move is likely to confront stiff resistance near a short-term descending trend-line, forming a part of a bearish triangular formation on the 4-hourly chart.

GBP/JPY 4-hourly chart

Spot Rate: 143.71

Daily Low: 143.07

Trend: Intraday bullish

Resistance

R1: 144.00 (round figure mark)

R2: 144.37 (R1 daily pivot-point)

R3: 145.00 (last week's swing high)

Support

S1: 143.40 (horizontal zone)

S2: 143.07 (current day swing low)

S3: 142.53 (S1 daily pivot-point)