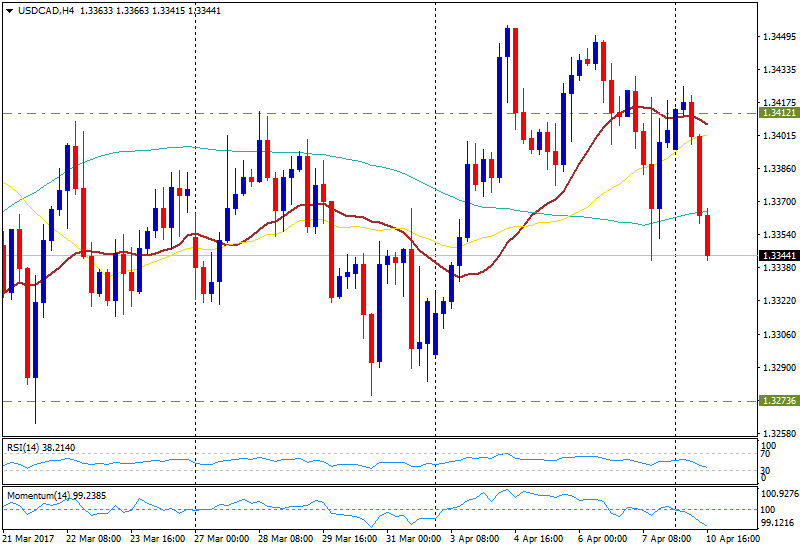

USD/CAD extends slide to test Friday’s lows

The Canadian dollar is among the top performers in the currency market on Monday. USD/CAD just printed a fresh daily low at 1.3340, the same level of Friday’s lows. Price remains era the bottom, holding a bearish tone.

The decline was favored by a rally in crude oil prices and a decline of the US dollar. The WTI barrel is up by more than 1%, currently slightly below $53.00. The greenback is pulling back after rising sharply last week. The US dollar index reached a fresh low at 100.85 as it continues to retreat from 3-week highs.

Next key event: BoC

On Wednesday, the Bank of Canada will announce its decision on monetary policy, one of the most relevant events of the week. “There is little doubt that policy is on hold. Under Governor Poloz, the central bank is very cautious despite a strong rebound in the last two quarters of 2016 (2.8% annualized pace in Q3 and 2.6% in Q4)”, said analysts from Brown Brothers Harriman.

They point out that the BoC expects the output gap to take another year to close. “Bringing it forward could spark investors to anticipate a rate hike sooner. Uncertainty about US policy (trade and fiscal) may discourage a significant change in rhetoric.”

Technical levels

To the downside, support levels might be located at 1.3340 (Apr 7 & 10 low), 1.3315 (Mar 23 low) and 1.3300 (psychological). On the opposite direction, resistance could be seen at 1.3370 (20-day moving average), 1.3425 (daily high) and 1.3455 (last week high).