USD/JPY Price Analysis: Bears testing bull's commitments at 131.50 ahead of US CPI

- USD/JPY levels to watch are now 131.50s support and 131.383 swing lows.

- Should the bears take control below 131.00 the bullish bias will turn negative.

USD/JPY is down some 0.5% on the day following the Bank of Japan headlines: BoJ to review side effects of its massive monetary easing at its policy meetings next week – Yomiuri.

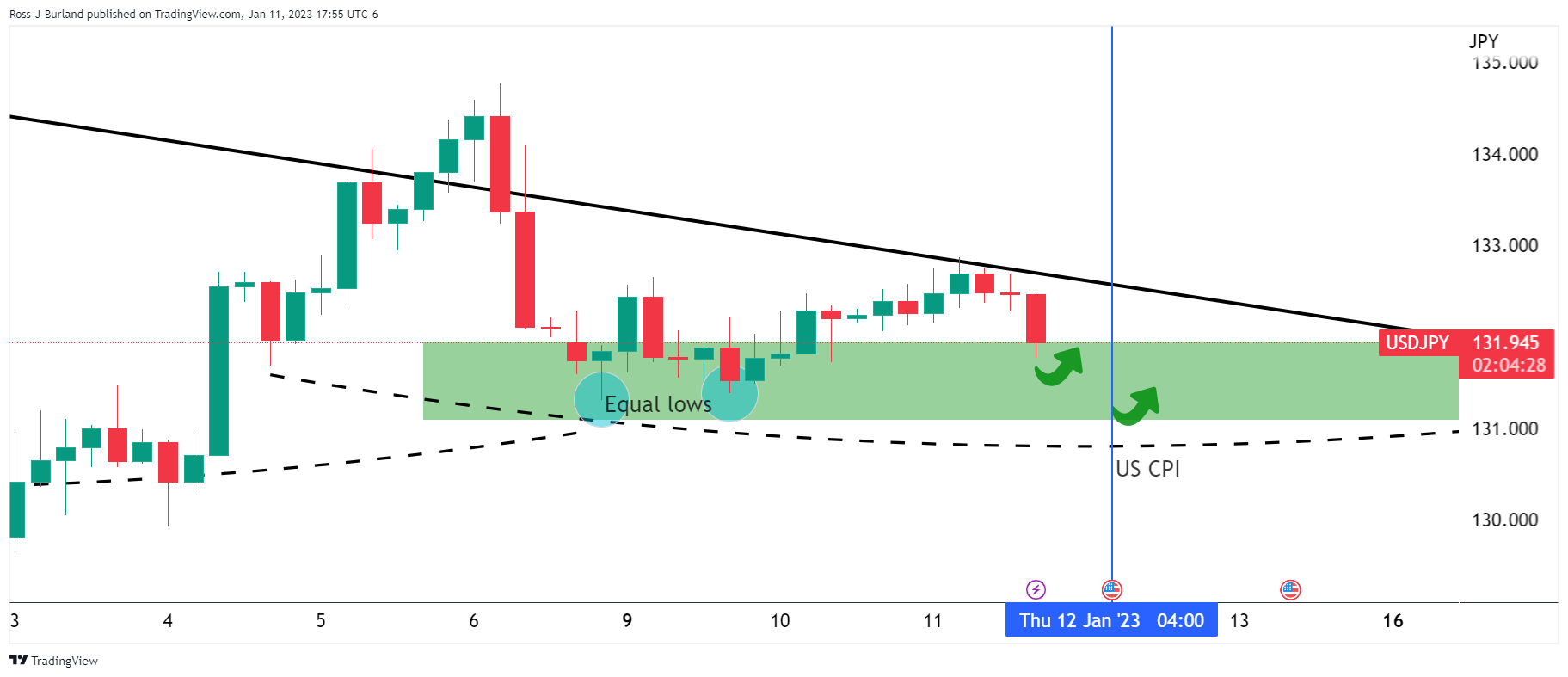

Meanwhile, the technical outlook is mixed given the sudden drop in the price but so long as the bulls hold off the bears at around 131.50, then the bias is tilted to the upside. There is room for further declines for which the bulls will still be in the runnings for poll position into the US Consumer Price Index later today, but they could well capitulate on pressures below 131.38 recent lows.

USD/JPY technical analysis

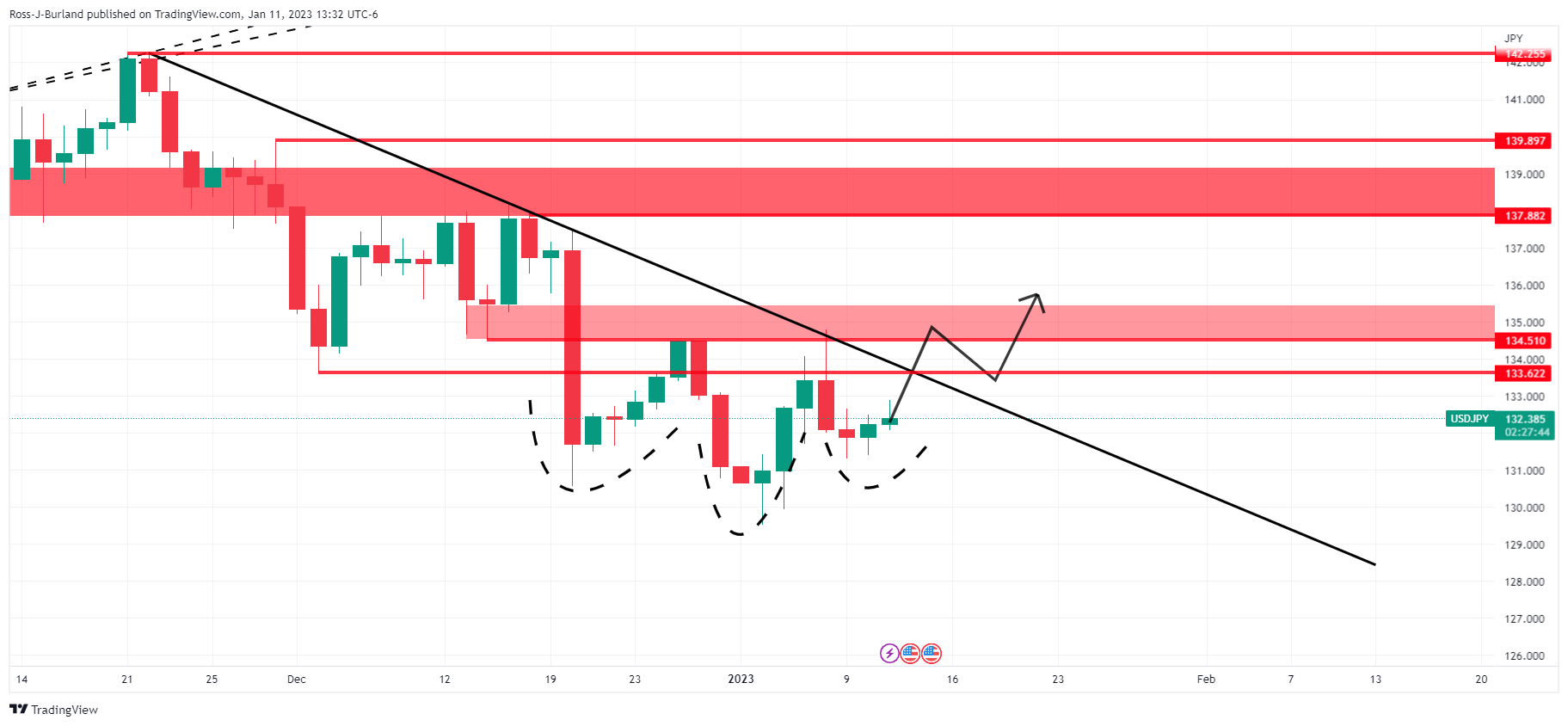

Meanwhile, as per the prior analysis, USD/JPY Price Analysis: Consolidation into US CPI, bulls on the prowl, the price remains inverse daily head and shoulders and there could be a reversal on the cards.

USD/JPY update, daily and H1 charts:

As we head over to the US CPI event, the levels to watch are now 131.50s support and 131.383 swing lows. There will be orders below these levels that could be traded before the reversal. With that being said, should the bears take control below 131.00 the bullish bias will turn negative.